MCo’s solutions

OUR BUSINESS

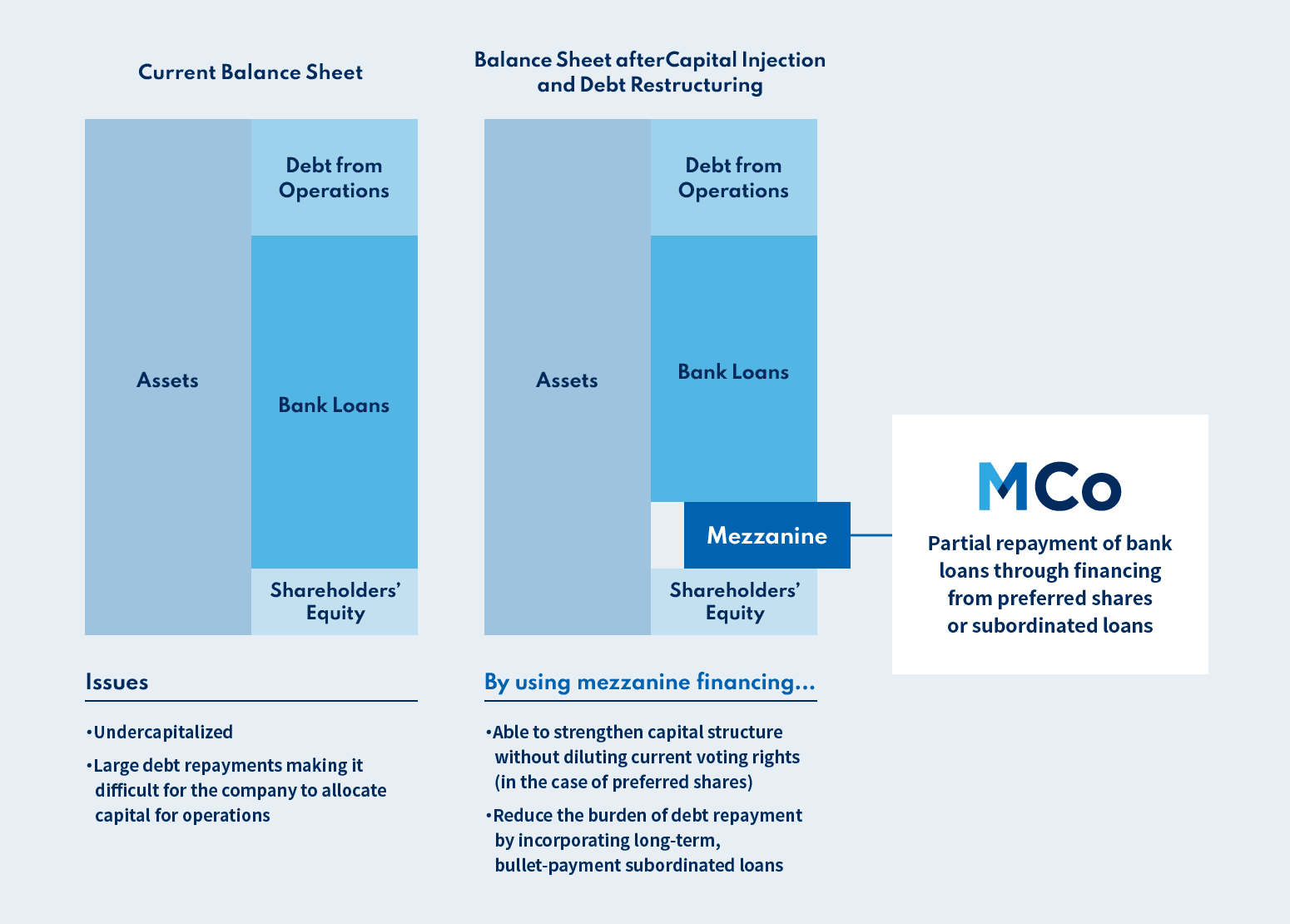

Capital injection and debt restructuring

Raising capital by preferred share issuance (capital without voting rights) allows companies to increase their capital without diluting voting rights.

By refinancing portions of bank loans with subordinated loans (long-term, bullet payment), companies can increase cash allocated for use in its business operation.

Target needs

- Companies wishing to raise additional capital without diluting voting rights of existing shareholders due to temporary losses from operation

- Companies wishing to review their repayment schedule to financial institutions due to a temporary deterioration in business performance or cash flow.

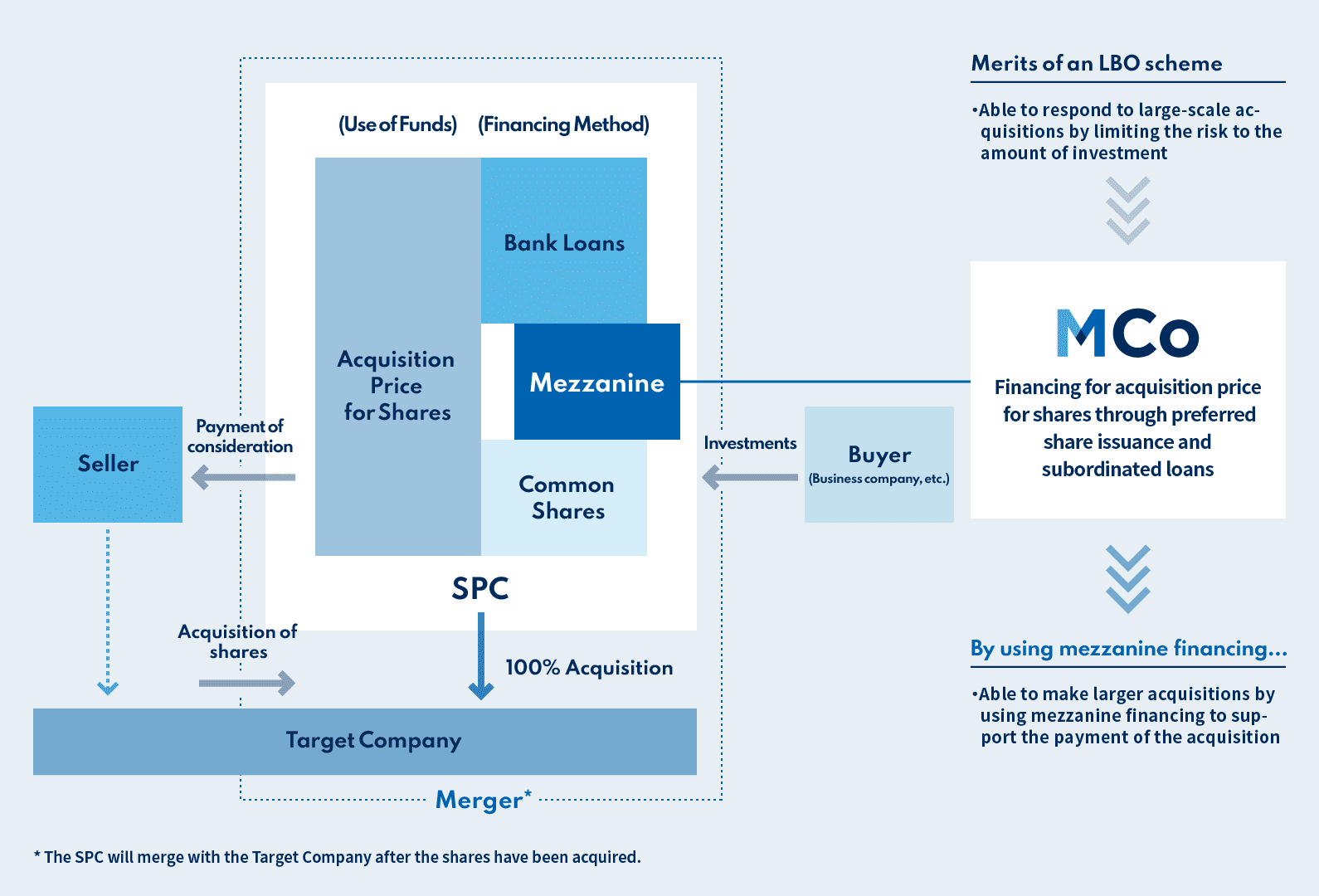

M&A Financing (LBO)

LBO allows companies to make large acquisitions with limited equity investments. Use of mezzanine finance allows a buyer to limit risk to amount invested and execute M&A with transaction values beyond its own size.

Target needs

- Companies planning LBO, such as acquisition of a larger business, but financing from banks is not enough to cover the acquisition

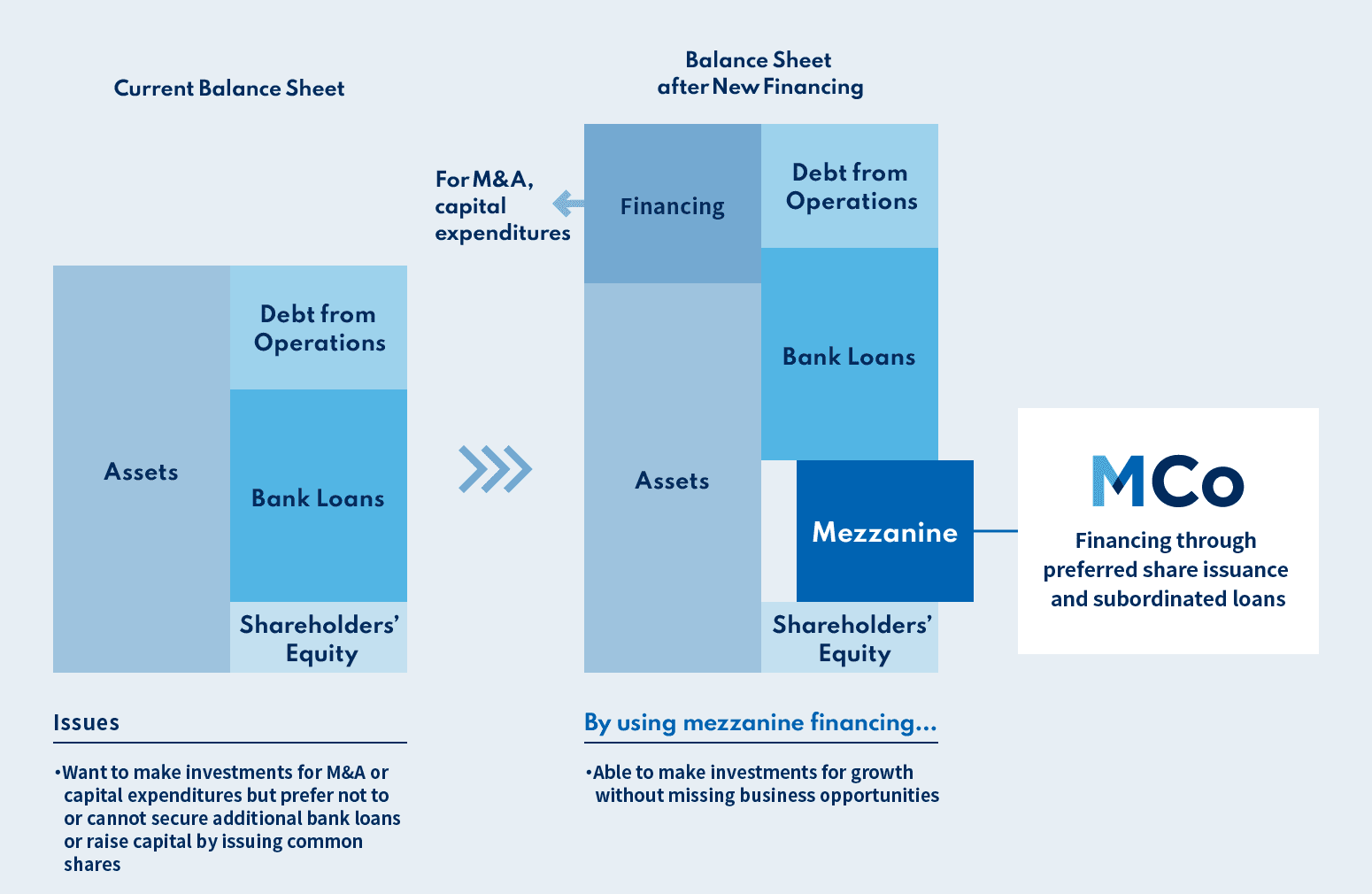

New financing

Even in cases where new capital injection by common share issuance or bank loans are difficult, companies can secure investment resources for M&A and capital expenditures.

Target Needs

- Companies with the need for capital but for whom an additional bank loan is difficult

- Companies that are at the stage of breaking away from the reconstruction process and are seeking to raise positive investment funds for regrowth

- Companies that have difficulty raising funds from financial institutions for some other reason

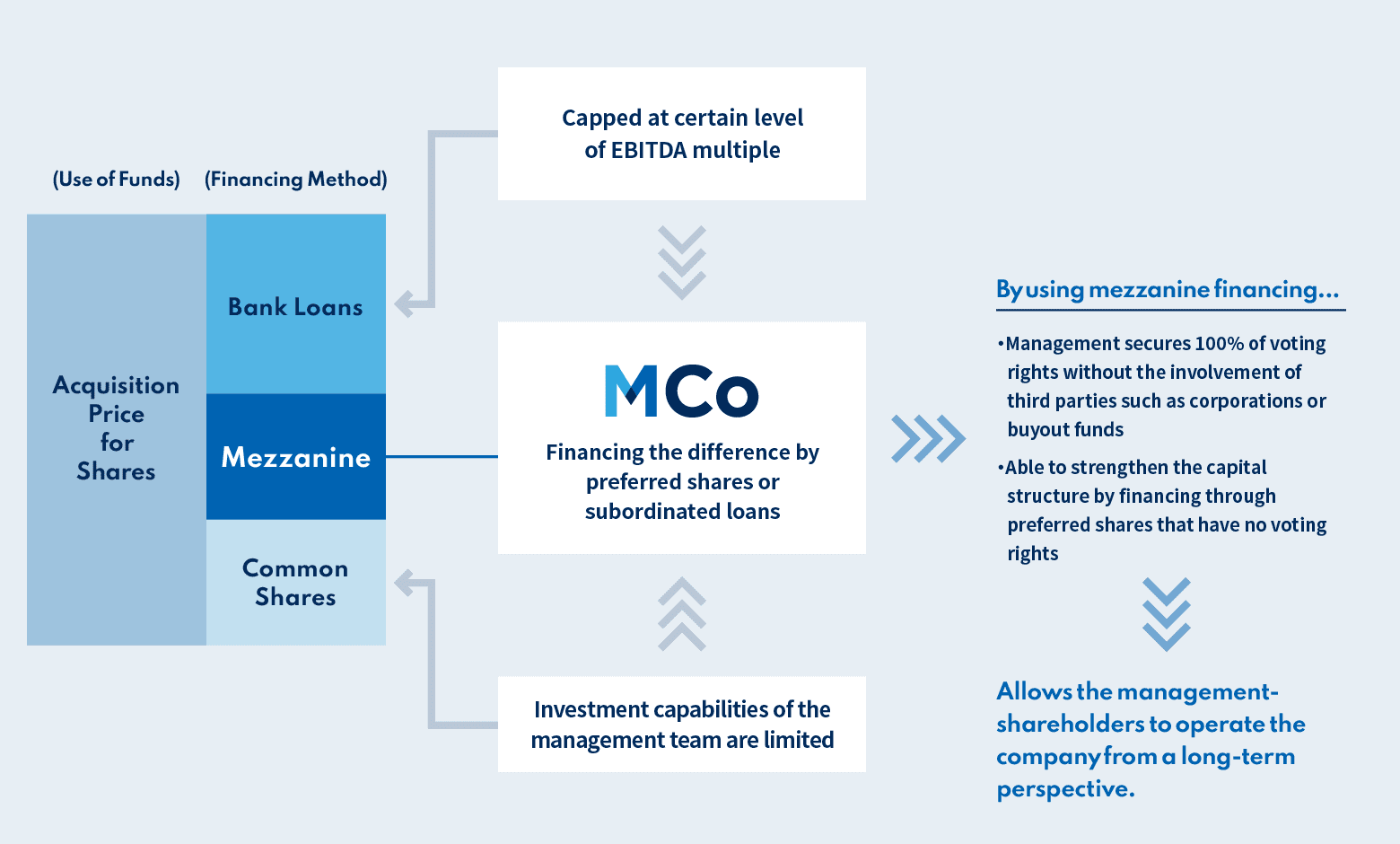

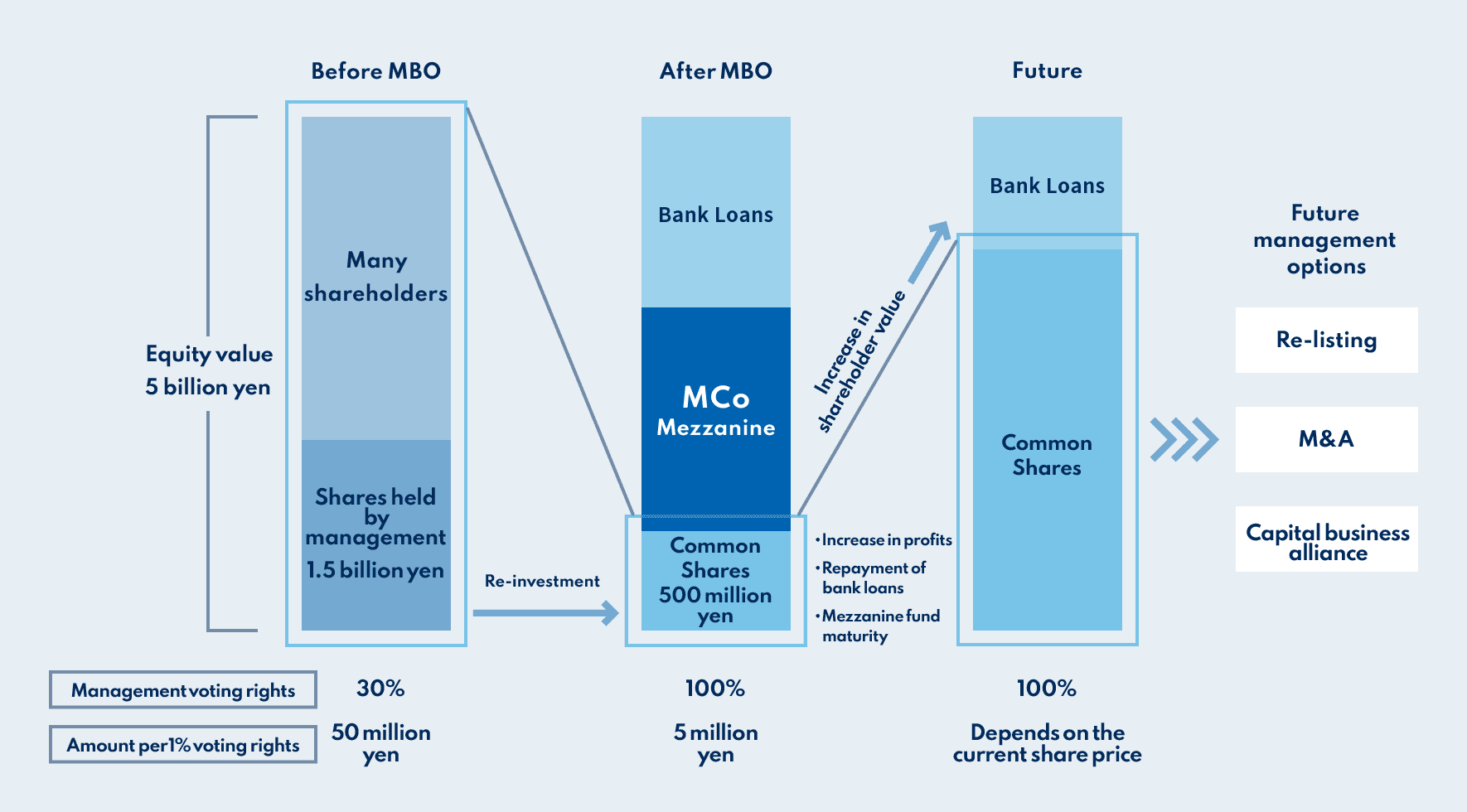

MBO (100% acquisition by management)

By utilizing mezzanine financing in an MBO situation, management teams can maintain 100% voting rights without having to fund the transaction on their own.

MBO (100% acquisition by management)

1) Results in lower price per 1% voting rights which allows for a flexible adjustment of shareholder structure.

2) Provides existing shareholders with an opportunity to cash-in their shares.

3) Allows management to directly capture the benefits of increase in shareholder value.

Target Needs

- Companies that are considering succession to successors and succeeding management team while ensuring capital independence (see “Use in business succession” below)

- Listed companies that are considering delisting under the leadership of management

- Companies considering becoming independent from a parent company and PE fund

| Needs for business succession | Example | Effect |

|---|---|---|

| 1) Need to have the business succeeded within the founding family | Eldest son of founder to buy shares owned by the founding family including the founder | Aggregation of shares to the founder’s eldest son who is part of the management team of the company Disposal of shares held by other members of the founding family |

| 2) Need to transfer the business to parties other than the founding family | Directors and employees to acquire shares from the founding family | Avoid situations where founding family members not involved in the management of the company are “left behind” as shareholders |

| 3) Need to become independent from parent company or buyout funds | Management to buy back shares from parent company or buyout funds | Maintain/increase independence Avoid being sold to other companies/buyout funds |