OUR BUSINESS

Japan's first

full-fledged

mezzanine fund

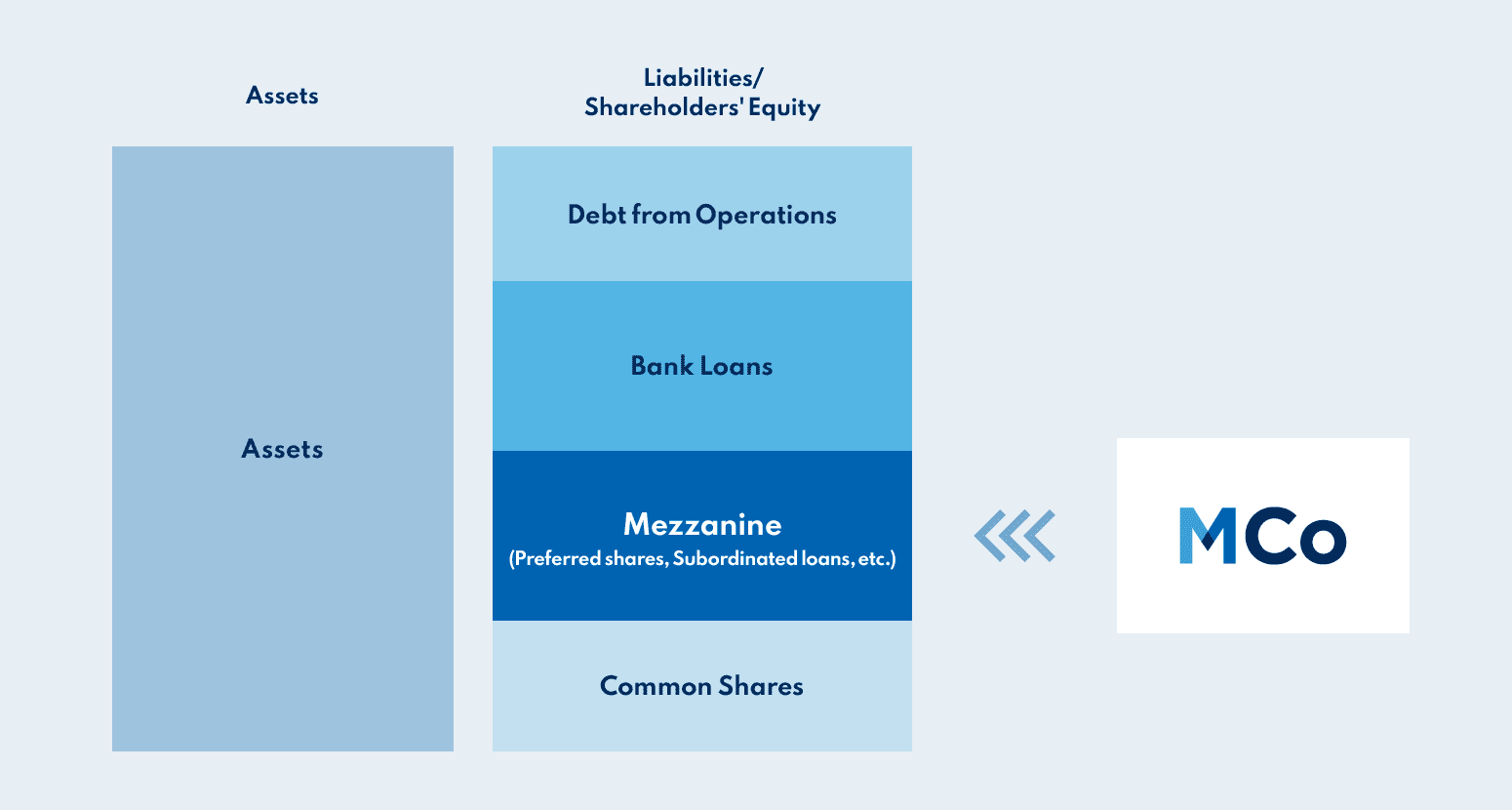

MCo manages investor funds through investing into companies via mezzanine finance. Our mission is to provide investors with medium-risk, medium-return investment opportunities and provide companies with new financing means and financial solutions to manage capital, thereby connecting both parties and contributing to Japan’s growth and development.

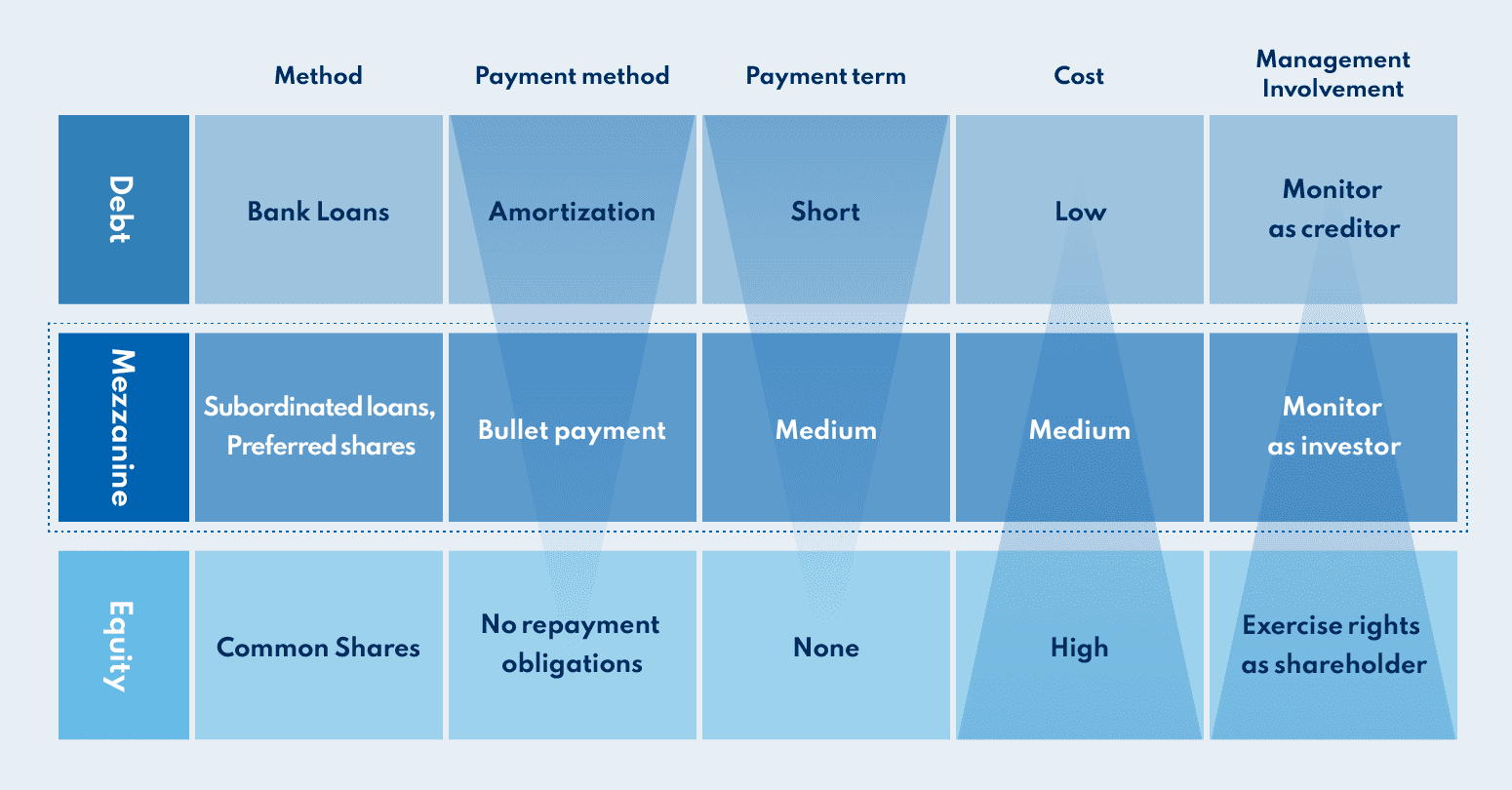

Mezzanine

Mezzanine financing is a financing method that is positioned between debt (bank loans, etc.) and equity (common shares).

Preferred shares: Holders have priority in the payment of dividends but no voting rights.

Subordinated loans: Type of loan that ranks behind bank loans in interest and principal payments.

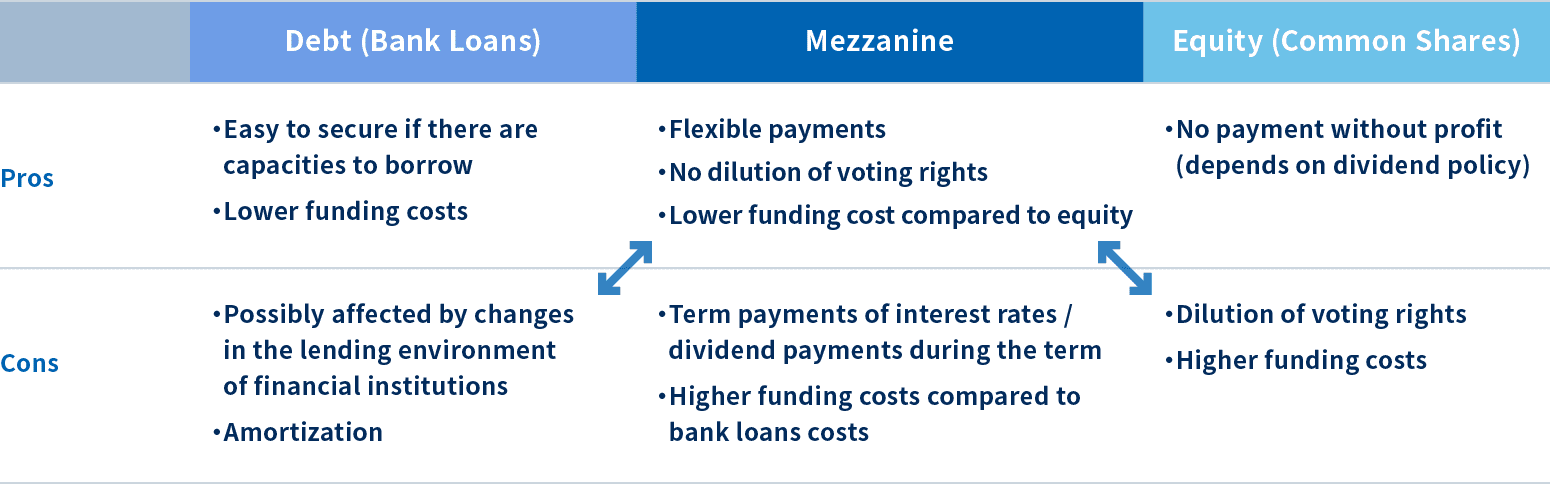

Pros & Cons of

Various Financing

Methods

Costs for mezzanine financing are higher than interest rate levels of contract bank loans; however, financing is designed with the combination of 1) cash payments of dividends and interest, and 2) PIK, or lump-sum payments of interest and dividends. By adjusting 1) and 2) in line with the operational cash flow, companies can reduce the amount of cash payments during the loan period.